How does SEPA direct debit work?

SEPA Direct Debit enables a creditor to debit a sum in euros from the account of its debtor, located in the SEPA zone.

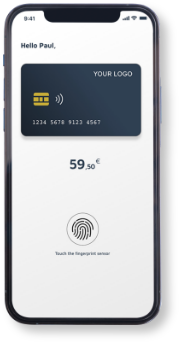

Treezor’s SEPA Direct Debit solution is designed to simplify the management of your recurring and automated payments across the SEPA zone. When you choose Treezor, you benefit from a solution that integrates easily into your existing ecosystems, and a reliable service that complies with European standards.

Contact us !SEPA Direct Debit enables a creditor to debit a sum in euros from the account of its debtor, located in the SEPA zone.

At Treezor, we offer two types of SEPA Direct Debit (SDD):

The period of validity of a SEPA direct debit mandate depends on the wording of the mandate, which may be:

However, if no direct debit order is presented for 36 months, the mandate lapses.

SDD Core

SDD CoreThe Treezor API can also be used to issue and receive SDD Core direct debits with the following features:

SDD B2B

SDD B2BThe Treezor API can also be used to receive a B2B direct debit request with the following features:

Use our API to offer your customers an online SEPA direct debit solution to facilitate recurring collections (outgoing and incoming). On request, we can take the necessary steps with the Banque de France to obtain a CID in your company’s name.

Simplified automation

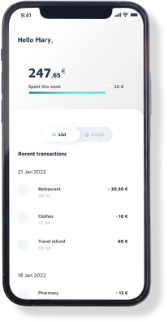

Simplified automationOur SEPA direct debit solutions automate recurring payments, reducing administrative tasks and minimizing the risk of errors.

Pan-European coverage

Pan-European coverageBenefit from extensive coverage throughout the SEPA zone. Facilitate transactions in the SEPA zone without extra effort.

Security and compliance

Security and complianceWith Treezor, every transaction is protected by security protocols, guaranteeing compliance with European standards.

Flexibility and adaptability

Flexibility and adaptabilityCustomize your direct debits to suit your specific needs. Whether for one-off or recurring payments, our solution adapts to your business model, offering you tailor-made financial management.

As a reminder, SDD Core is designed for consumer and business use, while SDD B2B is exclusively for business-to-business transactions.

SDD Core Direct Debit

SDD Core Direct DebitThe SDD Core direct debit can be used in the following cases:

SDD B2B

SDD B2BThe B2B SDD can be used in the following cases:

Do you want to grow your payment project? Just fill out this form. One of our experts will contact you as soon as possible.