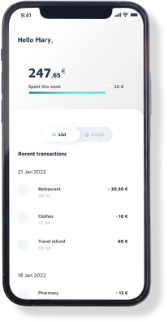

How does the virtual IBAN work?

Virtual IBANs are an alternative to traditional IBANs. They route incoming (or outgoing) payments from a company to the main IBAN. These funds are then consolidated into a single account, making it easier to track transactions.

Configuration limited to a single direction

Configuration limited to a single direction Predefined number of transactions

Predefined number of transactions Control over total transaction amounts

Control over total transaction amounts Time restrictions

Time restrictions Customize management rules

Customize management rules Flexible modifications

Flexible modifications Easy deactivation

Easy deactivation