5 reasons to integrate financial services into your offer and user experience

Improving customer experience

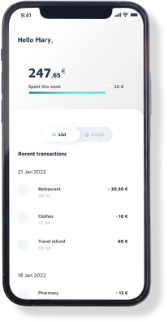

42% of online shoppers have already abandoned their purchase journey because of the complexity of payment validation. Offering end-customers financial services via a BaaS (Banking-as-a-Service) platform therefore means increasing efficiency, thanks to intuitive and seamless applications they are now familiar with using on a daily basis.

Providing better knowledge of the market and the customers

Integrating financial and banking services enables data collection on customer profiles and consumption habits. Analyzing this data also allows us to imagine new services.

Allowing a more efficient and productive organization

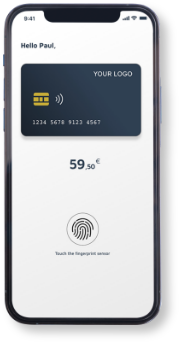

The integration of financial services allows companies to be more efficient. All businesses are affected, and companies are therefore moving towards more flexible and real-time management systems. This ease of management is largely supported by embedded finance modules that are seamlessly integrated into applications. This is how the “neo-banks” have emerged, thanks in particular to the development of BaaS platforms.

Generating new sources of revenue

One of the great strengths of embedded finance is the interoperability of solutions, allowing it to expand its service offering. Aware of this strong potential, Treezor has thus integrated Franfinance’s API into its One-stop-shop offer, allowing it to provide its customers with a consumer credit offer.

Using a technology of the future

Far from being a static technology, BaaS platforms are constantly innovating and providing new solutions. The payments industry is evolving rapidly, and all players must be capable of responding to important challenges. One of these challenges is technology.