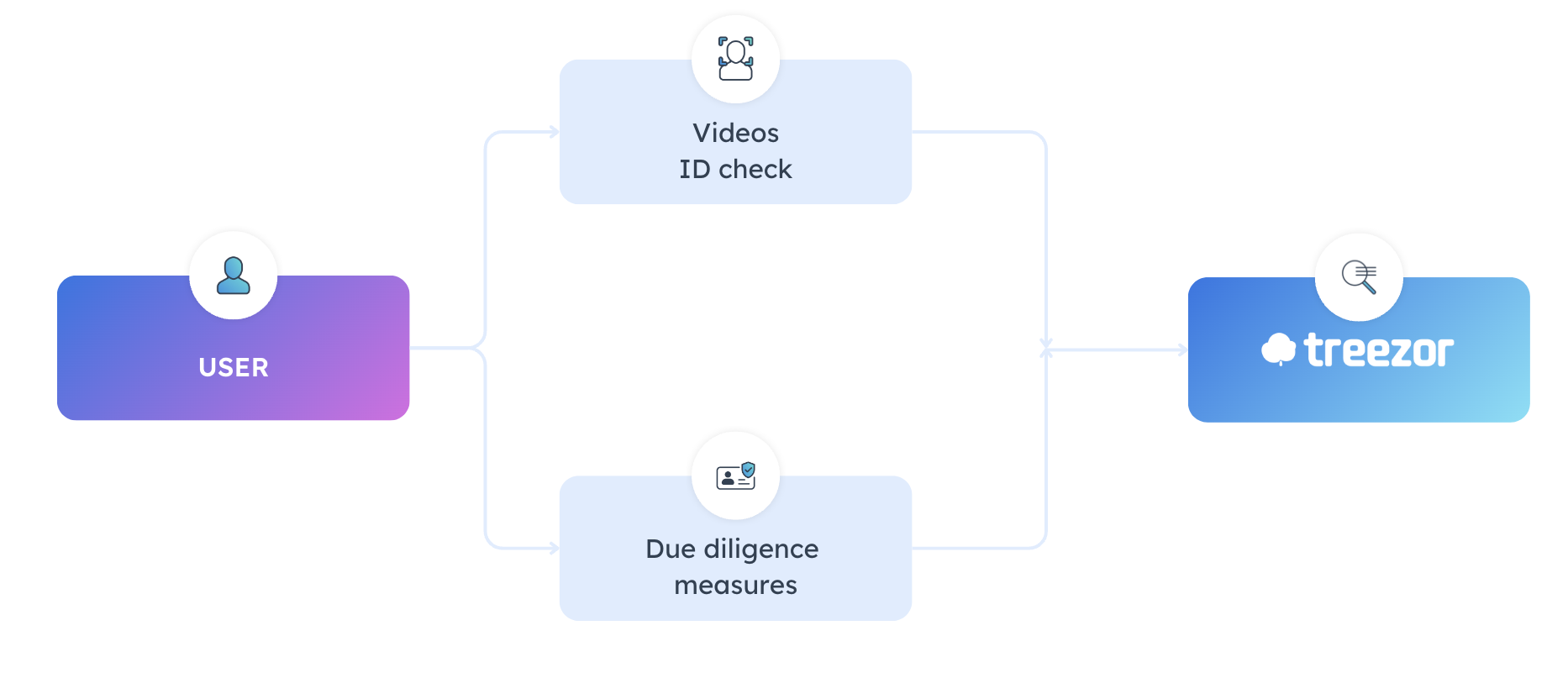

How does Treezor’s Liveness solution work?

The Liveness solution, available via the Treezor API, is an innovative method of video identity verification. It is based on a three-step process to guarantee a robust and compliant new relationship mechanism.

Step 1: Automatic verification

Step 1: Automatic verification Step 2: Additional vigilance measures

Step 2: Additional vigilance measures Step 3: Manual check

Step 3: Manual check

Human fraud expertise

Human fraud expertise Video capture

Video capture