Context: a promising sector

In line with the commitments made in the Paris Agreement, the countries of the European Union have resolved to achieve carbon neutrality by 2050. In collaboration with its cities and regions, the European Union is thus working towards a sustainable urban mobility strategy, including the introduction of soft mobility solutions for Europe’s working population.

France stands out among the leaders in this sector, with 76% of French companies having already introduced mobility solutions for their employees, exceeding the European average, according to the 2023 Fleet and Mobility Barometer. This testifies to the success of initiatives aimed at improving employee mobility.

Mobility vouchers

In France, the Loi d’Orientation des Mobilités (LOM), enacted on December 24, 2019, was introduced to encourage the adoption of environmentally-friendly modes of transport.

Similar to luncheon vouchers, the “titre-mobilité“, issued by a specialized company, can be purchased by the employer in exchange for its paid-up value and possibly a commission. Intended for distribution to employees, it can be used in various establishments such as bicycle stores and car-sharing platforms, in accordance with the official list of special dematerialized payment vouchers (TSPD).

Enshrined in the Loi d’Orientation des Mobilités (LOM) enacted on December 24, 2019 and in force since January 1, 2022, the titre-mobilité has emerged as a central element in the management of employee benefits, offering companies an innovative solution for optimizing their employees’ professional mobility. It aims to simplify daily commuting and encourage the use of sustainable means of transport for home-to-work journeys. You can find the official list of special dematerialized payment vouchers in application of article L. 525-4 of the French Monetary and Financial Code.

Mobility vouchers linked to the “Forfait Mobilités Durables” (Sustainable Mobility Package)

Introduced by the French Mobility Orientation Law (Loi d’Orientation des Mobilités – LOM), the FMD is an incentive tool for employees promoting soft, shared and low-carbon mobility.

In concrete terms, the FMD allows employers to grant up to €700 a year, exempt from social security contributions, to their employees for expenses related to the home-work commute. If an employee combines the FMD with the compulsory coverage of public transport costs, the exemption applies up to €800, or up to the amount of the compulsory coverage if this exceeds €800. In addition, the FMD can be combined with optional coverage of fuel or supply costs for environmentally-friendly vehicles, up to an overall limit of €700 per year. The condition is that these journeys must be made using environmentally-friendly means of transport, such as personal bicycles, car-pooling, public transport (excluding season tickets), scooters, etc.

Employees no longer need to provide proof of travel or request reimbursement. Mobility passes are issued in the employee’s name and remain valid until the last day of the calendar year in which they were issued. It should be noted that, unlike the reimbursement of public transport costs, participation in personal transport costs via the sustainable mobility package is not compulsory. It is a matter for the employer to decide, and can be agreed by the company and employee representatives.

This initiative aims to encourage the use of more environmentally-friendly means of transport, facilitating payment thanks to a dematerialized payment solution. It also enhances employees’ purchasing power by reimbursing their personal means of transport, while providing the company with automatic exemption from social security contributions and taxes.

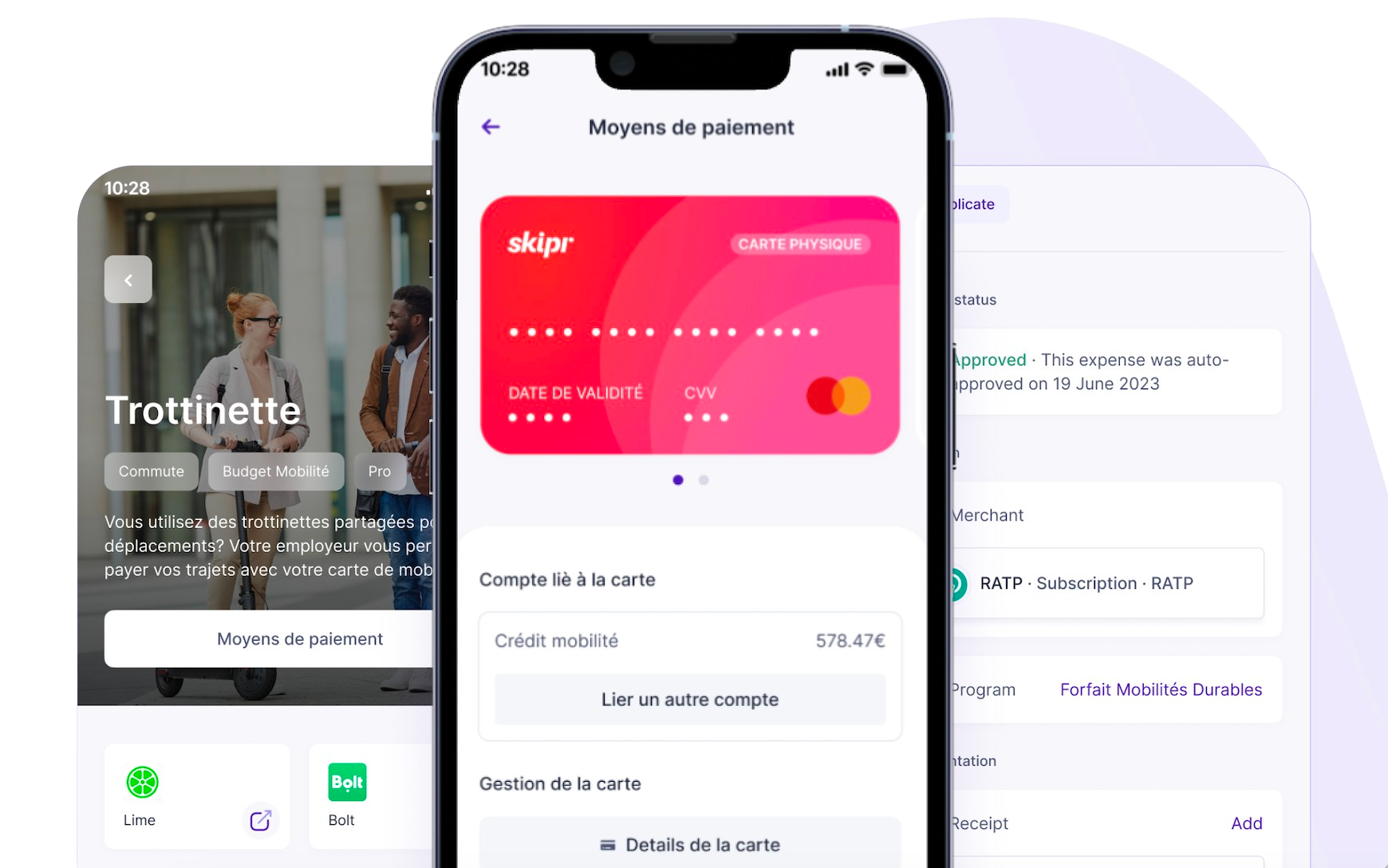

In this context, Treezor can help you set up and issue a payment card (physical and/or virtual version), which can be configured by your corporate customer and complies with regulations. The card is used by employees to pay for mobility-related services such as electric vehicle recharging, fuel, etc.

Business travel

Employees are often required to travel on company business outside their usual place of work. The employer is legally obliged to reimburse the employee’s travel expenses, including accommodation, meals and transport.

It’s common for professionals to perform their duties away from their usual place of work or home on business trips. In France, these business trips are governed by legal rules such as mileage allowances, travel management, company travel policy (PVE), Flying Blue Miles, and so on.

The business travel policy is a crucial element for any company. It sets out the general guidelines for business travel planning, reservations, preferred modes of transport and reimbursement of travel expenses. A clear policy contributes significantly to employee information and peace of mind. To facilitate the management of business travel expenses, Treezor offers a payment card solution with very fine-tuned settings, making it easier to control and monitor expenses. For the employer, the cards are set up according to the company’s internal policy; for mobile employees, this solution simplifies mobility and expense management.

Carte “Essence”

For companies with a fleet of vehicles, the fuel card facilitates fleet-wide management of fuel costs, including tracking of mileage and consumption. Offering a certain level of security and potential tax benefits, the fuel card is also a practical solution.

The fuel card, designed specifically to cover fuel costs, is a valuable tool for companies and employees alike. By enabling greater control over spending, managers can define usage limits, helping to keep fuel costs under control. Detailed transaction tracking simplifies expense management, providing clear visibility on the use of fuel funds. On the employee side, it simplifies the travel expense reimbursement process.

Why opt for a mobility card?

Implementing sustainable mobility practices within a company offers a number of strategic advantages. It helps to reduce carbon footprints, comply with current regulations and avoid financial penalties. What’s more, it enhances the company’s image and employer brand by appealing to customers and talent who are sensitive to environmental issues.

At the same time, sustainable mobility contributes to substantial savings in operating costs, notably by reducing expenses linked to business travel. Companies can also benefit from tax advantages, such as the tax credit for energy transition, by adopting measures such as the use of electric vehicles and support for sustainable modes of transport. Sustainable mobility is thus a legal necessity, an asset for the company’s image, a source of significant savings and an opportunity to benefit from tax advantages.

A corporate mobility card is a tool to help companies manage employee travel efficiently. There are many reasons to adopt a corporate mobility card: the ability to manage expenses, facilitate travel, optimize costs, track in real time, promote sustainable mobility, simplify administration and improve security. Issuing a mobility payment card enables companies to outsource the tasks of collecting, verifying, validating, aggregating and reimbursing mobility expenses, while controlling employee use of the budget themselves.

Why choose Treezor to issue a mobility card?

Innovative technological solutions

Treezor supports sustainable mobility players in the development of offers and services thanks to its embedded finance solution, integrating innovative, frictionless payment solutions for end-users.

Treezor’s services include opening payment accounts, issuing customizable and co-branded payment cards compatible with X-Pay, and customizing card payment thresholds and restrictions to meet the business rules defined by your corporate customers. Treezor places security at the heart of its priorities, and implements measures to control card use, including the ability to set thresholds and limits for your corporate customers’ cards. Tracking and reporting tools are also available to enable companies and their employees to monitor their mobility expenses, manage their budgets and generate detailed reports.

Lastly, Treezor’s Rules Engine (Multi-criteria Dynamic Card) gives companies the flexibility to adjust card usage rules to suit their specific needs (limit the ceiling, etc.) and industry requirements (restrict the network of affiliated retailers). In addition, this feature enables the integration of external data sources, enriching the decision-making process. Not only can companies customize their business rules, they can also optimize their choices by integrating relevant external data.

Advanced personalization of mobility and expense cards

Check out the most innovative features of Treezor’s corporate mobility cards below:

See the most innovative features of our mobility cards below:

Features |

Mobility cards issued by Treezor |

Rules engine

|

Card payment authorization

based on predefined parameters |

✔️ |

| Card design |

Customized card design and co-branding |

✔️ |

| Card security |

PIN and SCA codes |

✔️ |

|

Temporary card blocking |

✔️ |

|

Card cancellation |

✔️ |

| Expense management |

Management of limits and ceilings |

✔️ |

|

Access to real-time balances |

✔️ |

|

Personalized spending limits |

✔️ |

| Transaction management |

Retailer whitelisting |

✔️ |

|

Retailer blacklisting |

✔️ |

|

Real-time transaction notification |

✔️ |

| X-Pay |

Virtual card |

✔️ |

|

Apple Pay and Google Pay |

✔️ |

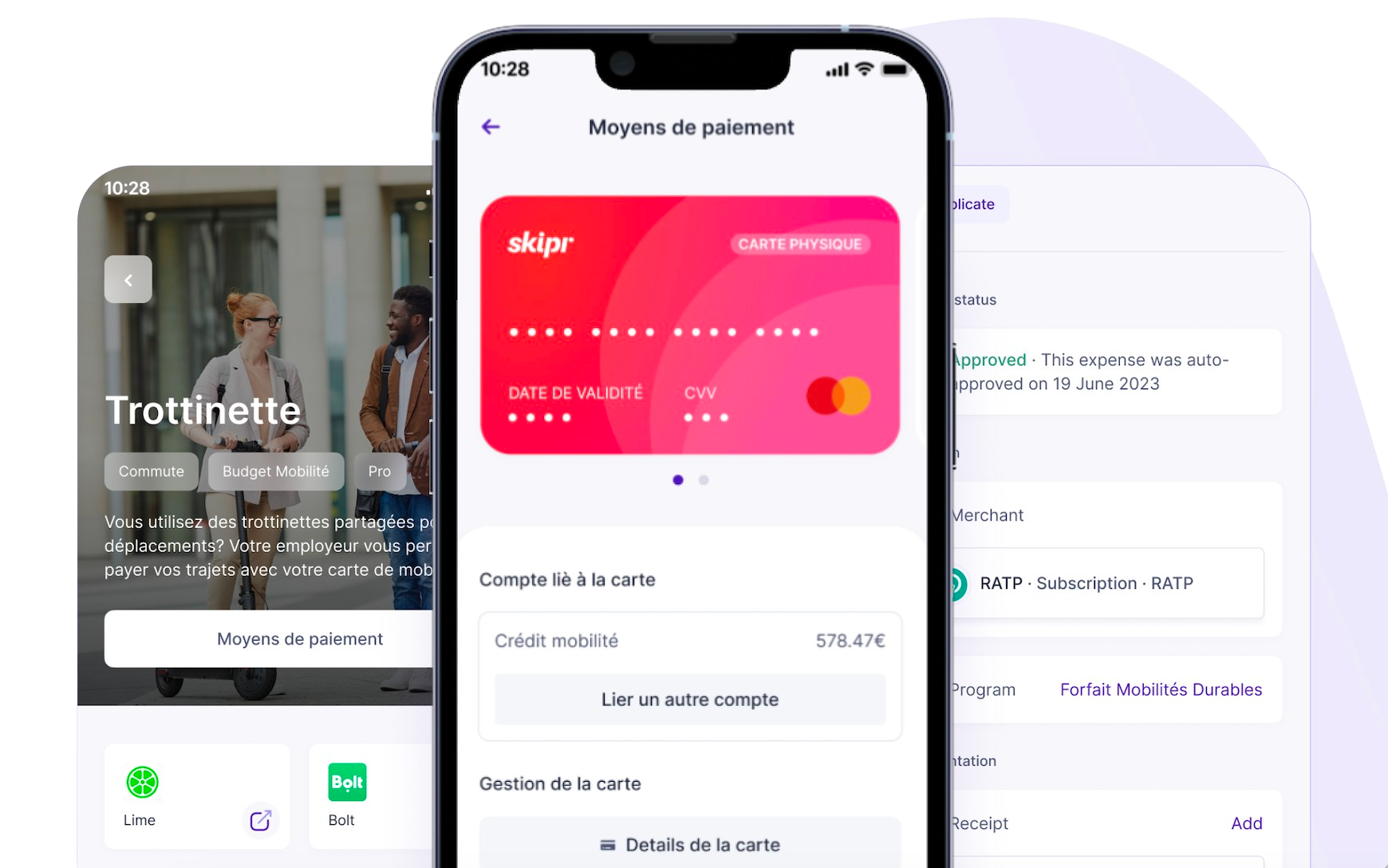

Mobility

Skipr

Enterprise mobility solution