Discover Treezor’s instant virtual card issuance solution

As an ACPR-approved issuer and leading member of schemes (Mastercard, VISA), Treezor offers an instant virtual card issuing service. Our virtual cards are based on the latest-generation Card Management System with advanced technical features. Customize your cards according to your different use cases while guaranteeing total control and optimum security. Simplify the creation of virtual cards and offer your users a unique payment experience with Treezor.

Contact us !

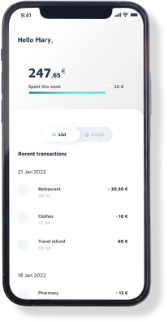

The virtual card is a digital payment solution, particularly suited to online transactions, with the same features as a physical card:

- 16 digits representing a unique identification number (PAN);

- an expiry date in MM/YY format;

- a three-digit card verification code (CVC or CVV).

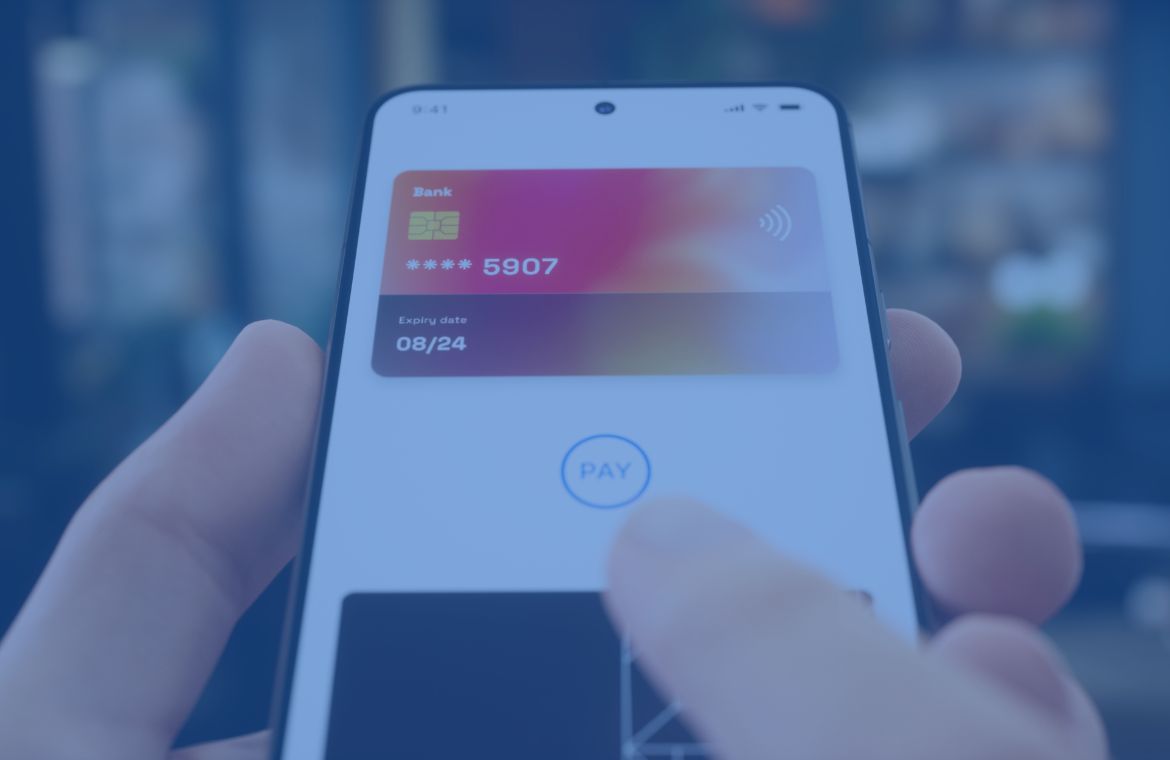

This dematerialized card can be used to pay for purchases online or in-store, provided it is compatible with digital wallets such as those from Google, Apple, Samsung or Garmin. Once added to the wallet, the user can pay for purchases using contactless payment and with no limit on the amount (can’t go over their limit).

Like physical cards, they can be configured to precise specifications, such as spending limits, merchant, or geographic restrictions, to meet the diverse needs of your customers.

Features and benefits of instant virtual card issuance

Instant emission

Virtual cards are created instantly, enabling immediate use as soon as they are issued. This speed is ideal for providing new customers with an immediate means of payment.

Single or permanent use

The virtual card can easily be configured to define its period of validity and ensure it corresponds exactly to your needs. It can be temporary, for one-time use for example, or a permanent replacement (1 to 5 years) for the physical bank card. In all cases, it can be created instantly (‘instant issuing’) and used immediately.

Advanced security

Virtual cards also enhance user security. Indeed, it is possible to hold several virtual cards to limit the risk of fraud. A cardholder can have a virtual card for a very specific use, such as a virtual card dedicated to online purchases, to a category of merchants or even to a single merchant.

Efficiency

The efficient use of virtual cards often translates into reduced administrative and operational costs.

Purchasing processes, especially for small purchases or routine transactions, can be time-consuming with traditional purchase orders or refunds. Virtual cards simplify and accelerate purchasing processes by providing better expense tracking. Digitization, process automation and analysis enable companies to manage their finances more effectively.

Why choose Treezor for instant virtual card issuance?

Together with its partners, Treezor offers instant issuance of payment cards, providing a comprehensive end-to-end solution.

Treezor’s regcognized expertise

Treezor’s regcognized expertise

EMI accreditation by the ACPR: benefit from the security and compliance offered by a regulated issuer.

Member of international networks such as Mastercard, with extensive process expertise

A robust, secure platform to support your business growth

Tailor-made support

Tailor-made support

Full support: from regulatory declaration to API integration and card program activation, Treezor – as BIN sponsorship – supports you at every key stage of the project (choice of product code, interchange optimization, limits, setting of anti-fraud rules, etc.)

a

Some use cases for instant virtual card issuance

While virtual cards are particularly well-suited to online purchases, they also have other interesting uses:

- for business travel, by determining a dedicated envelope for each trip

- for travel agencies, by issuing a single-use virtual card for each reservation

- to develop a gift or loyalty card program while limiting the number of cards in your wallet;

- to track and control employees’ business expenses, with the option of creating a virtual card for each subscription, making it easier to reconcile transactions and terminate a service;

- for companies concerned about their environmental impact and wishing to promote 100% digital solutions.

Let’s talk about your project!

Do you want to grow your payment project? Just fill out this form. One of our experts will contact you as soon as possible.