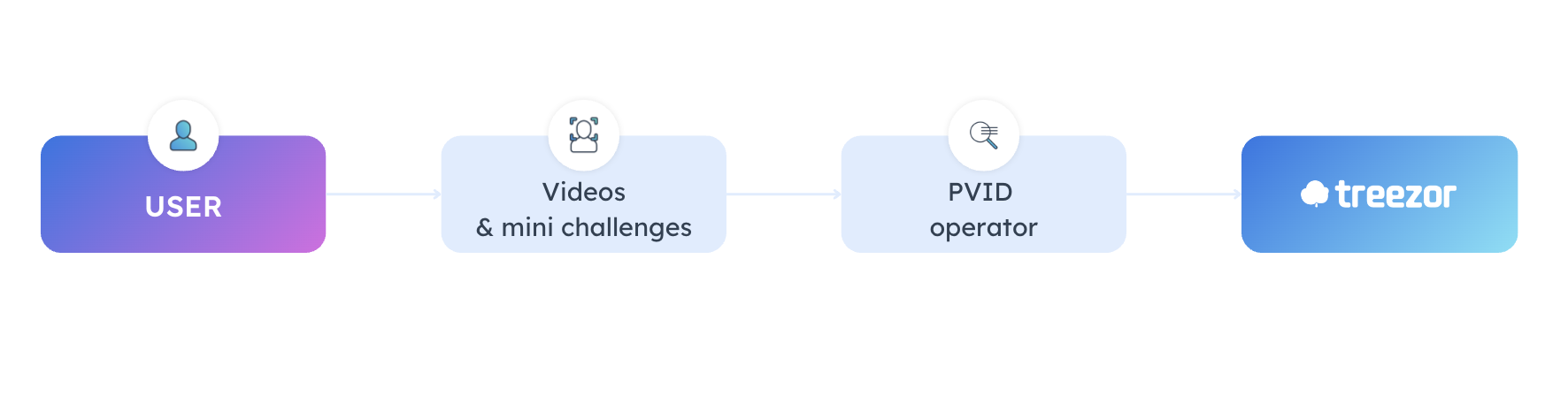

How does the PVID solution distributed by Treezor work?

The PVID solution is based on several steps to ensure a robust and compliant new relationship mechanism.

Do you Want to enhance the security and compliance of your identity verification process? Discover Treezor’s PVID (Proof of Remote Identity Verification) solution, a remote identity verification service certified by ANSSI (Agence Nationale de Sécurité des Systèmes d’Information, the French cybersecurity agency), which combines cutting-edge technology with maximum security. Designed to meet the most stringent compliance and anti-fraud requirements, this solution guarantees a seamless user experience and optimum protection.

Contact us!The PVID solution is based on several steps to ensure a robust and compliant new relationship mechanism.

Step 1: Initial user interaction

Step 1: Initial user interactionThe user first initiates identity verification via a platform or application. At this stage, the user enters their basic information and accesses the interactive part of the process.

Step 2: Interactive content

Step 2: Interactive content

The user is then presented with interactive elements such as explanatory videos or mini challenges. These challenges can include tasks to be completed in real time to prove the user’s presence, such as asking them to move their head, blink or answer questions based on identity documents. These steps help to reinforce security and prevent fraud.

1

Step 3: PVID analysis by an operator

Step 3: PVID analysis by an operator Once the videos and challenges have been completed, a PVID operator takes over. This involves checking the authenticity of documents submitted by the user, such as ID cards or passports. The analysis includes facial recognition to compare the person in the video stream with the photo on the document, and other checks to ensure the validity of the identity documents provided.

Step 4: Validation by Treezor

Step 4: Validation by TreezorOnce the identity verification has been validated by the PVID operator, the information is then transmitted to Treezor, which is responsible for ensuring that the user’s KYC file is complete and compliant. Once this final analysis stage has been completed and validated, the user is fully authenticated and can access the financial services on offer.

The PVID solution has four key features:

Identity verification via a live video stream enables enriched information to be captured, optimizing the quality of the data collected and reinforcing security.

AI intervenes throughout the process to guide users in real time, automatically extract information from identity documents and assign an instant score. This technology optimizes conversion rates while reducing human error.

In case of doubt or uncertainty, KYC experts step in to examine the data collected, ensuring accurate verification when AI fails to assign a reliable score. This double check reinforces the security of the process and guarantees optimum fraud detection.

User data is processed and stored within a French sovereign cloud, certified by the regulators. This infrastructure guarantees full compliance with GDPR while ensuring that data remains protected within the European Union.

Regulatory compliance

Regulatory compliance

The proposed solution is designed to comply with French KYC requirements to combat money laundering and the financing of terrorism (AML/CFT), but with the ambition of fitting into a broader European framework.

Extensive coverage

Extensive coverage

This solution authenticates a wide range of identity documents (ID cards and passports), providing international document coverage.

Security and speed

Security and speed

PVID is the remote identity verification solution with the highest level of security. What’s more, you benefit from a unique identity verification solution with near real-time KYC file analysis

Do you want to grow your payment project? Just fill out this form. One of our experts will contact you as soon as possible.