Access to the SEPA (Single Euro Payments Area) network as a SEPA indirect participant represents a strategic challenge for regulated institutions. This status offers an advantageous position in the world of euro payments. It does, however, involve a number of administrative and technological steps.

How can you become a SEPA indirect participant? Treezor has the technology and regulatory expertise to support you in your dealings with the lead bank. Just follow the guide!

1. Join the select circle of SEPA participants

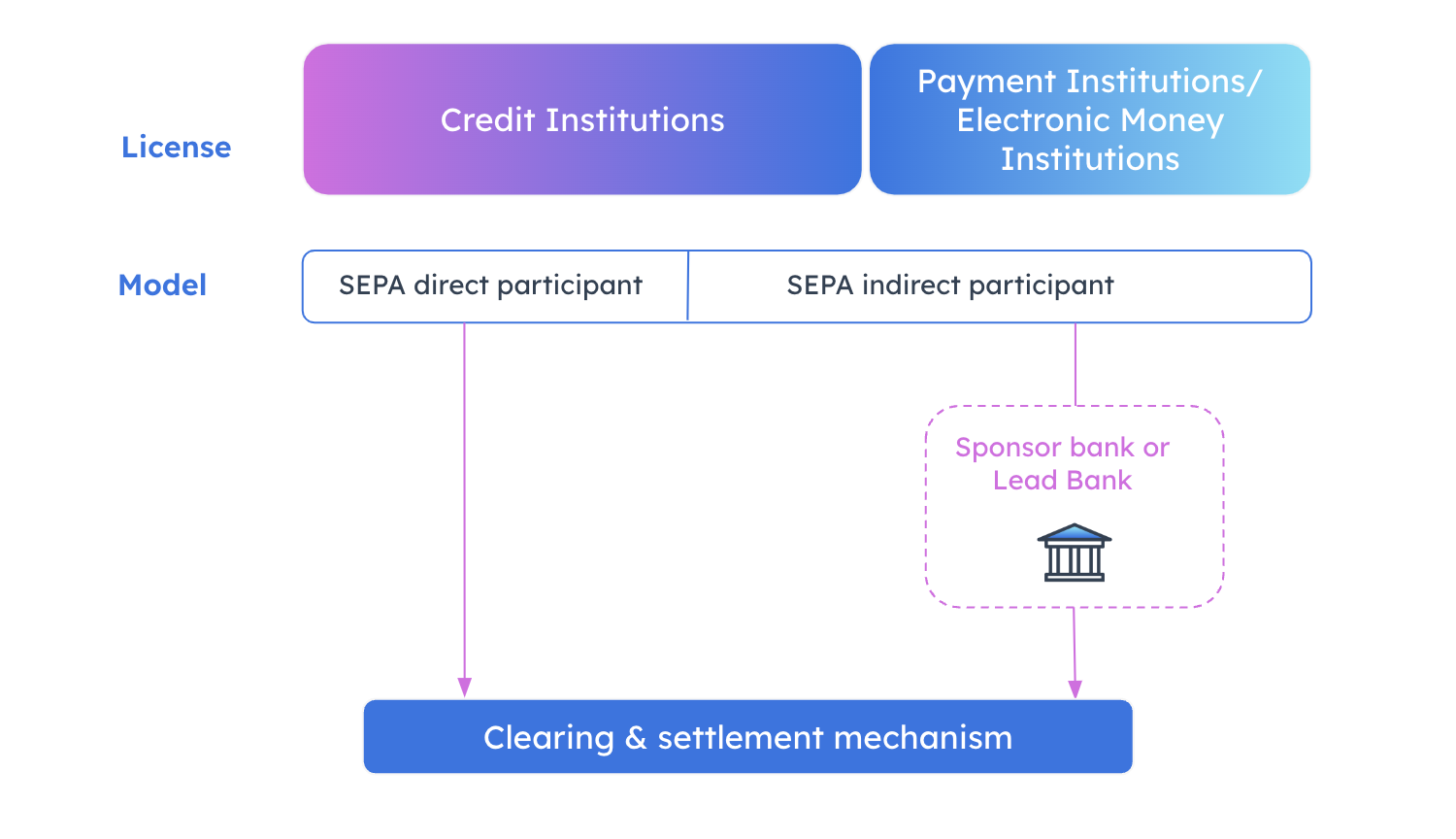

Becoming a SEPA participant enables you to control the payment chain and transaction costs. There are two different statuses: direct and indirect SEPA participant.

Direct and indirect SEPA participants: what’s the difference?

SEPA direct participants are credit institutions that have an account with the European Central Bank (ECB). They have direct access to the CSM (Clearing and Settlement Mechanisms) for incoming and outgoing payments in the SEPA zone.

SEPA indirect participants, on the other hand, need a sponsor bank, or lead bank, to connect to the CSM, which has the advantage of reducing integration costs and the operational burden by delegating some of the transaction controls. They must also demonstrate that they respect regulations and procedural compliance.

Becoming a SEPA indirect participant is, however, a less complex and less costly process overall than becoming a direct participant, and offers many advantages for managing SEPA payments.

Who can become a SEPA indirect participant?

To send and receive SEPA payments on behalf of your customers, via a lead bank, you must be an entity regulated by the regulator, in France the Autorité de Contrôle Prudentiel et de Résolution (ACPR) as a:

- credit institution;

- payment institution;

- or electronic money institution.

Did you know?As a regulated Electronic Money Institution, Treezor provides legal and technical support to regulated fintechs such as Shine in obtaining payment institution approval from the ACPR. Once this step has been completed, these same fintechs can choose their banking partner and become SEPA indirect participants. Treezor and Societe Generale have built a joint offer to support regulated scale-ups in their growth and autonomy.

2. Benefit from the advantages of indirect participant status

SEPA Indirect Participant status gives applicant establishments access to a number of advantages:

- process incoming and outgoing SEPA payment flows in compliance with regulations (SEPA Credit Transfer, SEPA Instant Credit Transfer, SEPA Direct Debit);

- exchange payment status reports with the lead bank;

- analyze error and exception messages (R-Transactions);

- manage customers’ accounts and secure their funds for transactions.

To obtain SEPA participant status, complex administrative and legal procedures must first be completed with the regulator. The KYC of the regulated entity must also be approved by the lead bank to validate the relationship and introduce the new member to the network.

Issuing dedicated IBANs

SEPA participants have their own BIC, or Bank Identifier Code, and are authorized to issue their own IBANs for their customers’ accounts. In this way, every incoming and outgoing SEPA transaction flow bears the brand name of the institution, reinforcing its credibility with other players in the sector and making it easier to track customer transactions.

A global view of SEPA payments

As a SEPA indirect participant, you have access to all your payment flows, including error and exception messages (R-Transactions). These communicate the causes of a failed transaction, such as a closed account, incorrect account number or duplicate payment.

You can then create customized reports, define monitoring rules and adjust your pricing policy to suit different situations.

Controlling the payment process

Being a SEPA indirect participant brings you closer to the CSM and gives you greater control over your SEPA payments. You have a strong partnership with your lead bank. That’s why, when choosing your intermediary, you need to pay close attention to its reliability and expertise. Your objective is to optimize the management of your transactions within a secure framework.

Did you know? SEPA Indirect Participant status gives applicant establishments access to a number of advantages:

- process incoming and outgoing SEPA payment flows in compliance with regulations (SEPA Credit Transfer, SEPA Instant Credit Transfer, SEPA Direct Debit);

- exchange payment status reports with the lead bank;

- analyze error and exception messages (R-Transactions);

- manage customers’ accounts and secure their funds for transactions.

3. Complete all the steps to become a recognized SEPA indirect participant

Becoming a SEPA participant remains a demanding process. It involves completing all the administrative formalities, selecting and meeting the requirements of the lead bank, and integrating SEPA payments into your system.

Administrative formalities

To qualify as a SEPA indirect participant, you need to request your BIC (Bank Identifier Code), which is the international identifier for a banking institution, from SWIFT (Society for Worldwide Interbank Financial Telecommunication).

The financial institution must also make a declaration to the EPC (European Payments Council) in order to join the SEPA payment network. The EPC registration process involves gathering extensive documentation, including a legal opinion to prove the compliance of the procedure and the legitimacy of the applicant.

Lastly, the selection of the CSM is carried out in partnership with the lead bank, and requires the BIC number be taken into account in the systems.

Selecting the lead bank

The choice of lead bank is strategic and depends on several key criteria:

- the type of SEPA payment offered (issue and receipt of SEPA credit transfers and SEPA direct debits);

- pricing policy;

- flow execution speed;

- experience in managing SEPA participants;

- complementary services such as fraud prevention;

- the quality of support functions;

- connectivity to the various CSMs for improved reachability throughout the SEPA area.

Technical integration of SEPA payments

To generate payment flows on behalf of its customers, the SEPA indirect participant needs to connect to the lead bank’s interfaces. It also needs a stable, efficient core banking system to handle all the tasks associated with its new status:

- assign an IBAN to each account;

- manage customer accounts (calculating balances, checking deposits, etc.);

- edit bank statements;

- ensure anti-money laundering and anti-financing of terrorism procedures (KYC, alert processing, etc.).

- manage the fight against fraud.

Developing a system to automate SEPA payment flows is a highly technical undertaking. Processes are poorly documented and require extensive testing before going live.

4. Take advantage of Treezor’s expertise to become a SEPA indirect participant!

Treezor, an electronic money institution and subsidiary of the Societe Generale group, is the European leader in Banking-as-a-Service. Authorized to operate in 25 countries, Treezor has developed an offer adapted to regulated institutions.

Treezor guides you in obtaining indirect participant status and offers technical integration with the lead bank (Societe Generale).

You benefit from reliable core banking functionalities that manage all payment transactions (flows and cards) in real time. You can offer all incoming and outgoing SEPA payment flows, including credit transfers (SCT, SCT Inst), and direct debits (SDD Core and SDD B2B). Your BIC number is recognized on the network, and you generate IBANs on your own payment accounts.