Project

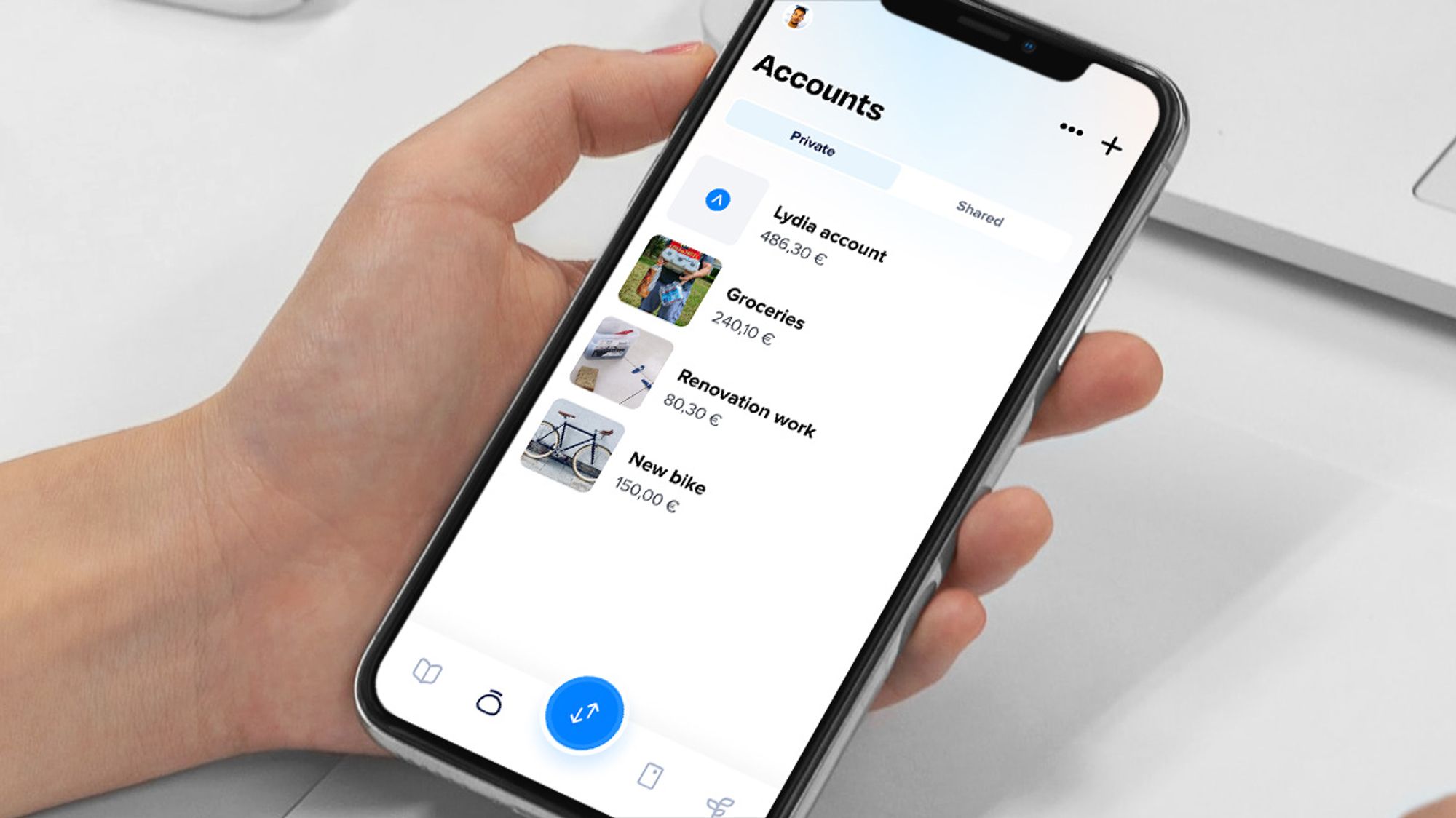

Lydia launched its payment app in 2013. Initially, it was a peer-to-peer payment app, aiming to facilitate the way individuals can pay off debts and send money to each other by registering any bank in the app and paying by scanning the QR code of someone also using the app.

In 2020, the company made its largest fundraising (€40 million) with Tencent, and joined the French Tech 120 – an index of the best tech startups in France.