The 2022 edition reveals the challenges of banking-as-a-service as well as the evolution of alternative payment systems such as BNPL (Buy Now Pay Later) or the potential of crypto-currencies. It also includes a mapping of key solution providers in the field of Open Banking and Open Finance, in which Treezor, Worldline, Finastra and American Express are featured.

Treezor was mentioned as a leader in the following categories:

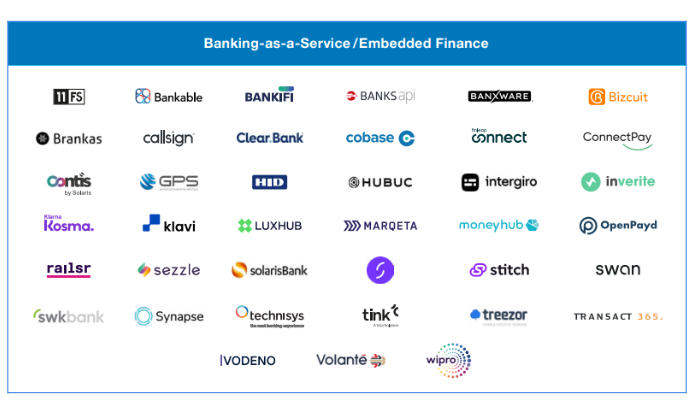

- Banking-as-a-Service / Embedded Finance

- Open Banking – Open Finance Infrastructure / Platform Providers

- Open Banking and PSD2 Compliance

- API Security and Monitoring

- Account-to-Account Payments

- Bulk Payments

- Variable Recurring Payments

- Financial management/ financial app

- Identity verification / KYC

- Digital wallets