Your One-stop shop for embedded finance

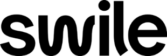

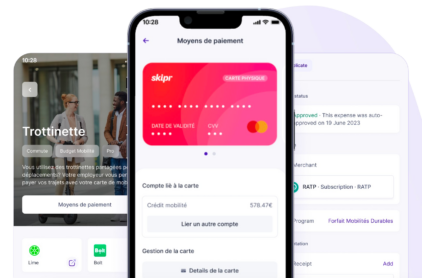

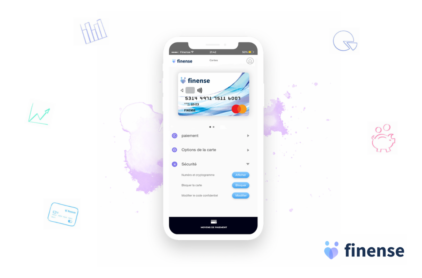

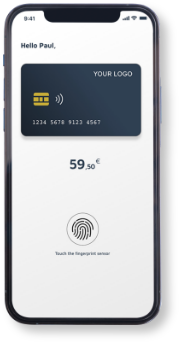

Embed financial services into your client experience and enhance your business offer thanks to Treezor’s white-label solution.

Treezor, the European Banking-as-a-Service leader, will support you throughout your payment project, every step of the way.

Get started Discover our servicesA wide range of financial services

We enable creative banking

Treezor is the European Banking-as-a-Service leader. Our modular one-stop shop solution makes it possible for any company (fintechs and large businesses) to accelerate their banking projects by outsourcing any of their payment needs to us. Rely on Treezor’s regulatory, security and tech expertise to smoothly embed payments into your customer journey.

Treezor: an enabler and a success maker

Treezor represents a creative and innovative hub for the best European fintechs to accelerate the digital transformation of payments.

One-stop shop.

One contract, one API, one integration.

Multiple services. Endless possibilities.

No matter what kind of project you have, Treezor, Banking-as-a-Service leader in Europe, offers a wide range of services and can support you throughout the entire payment cycle, from receiving to issuing payments.

Our international presence

& large network of partners

Our company is present throughout Europe

- Our local teams are based in 5 countries: France, Spain, Germany, Belgium & Italy

- We have 200+ employees of more than 20 nationalities

- Our clients are present in 8 countries within the E.U.

- We’ve partnered with well-known fintech associations